Workers' compensation payroll calculation is simply annual gross wages for all workers covered by the policy — whether you're looking for a new policy quote or submitting the payroll calculation report for an audit.

In this post, we break this down further — What does annual gross wages include? Which workers are covered by a workers' compensation policy? — so you get the right coverage for the best price.

Employers need to calculate payroll for workers' compensation insurance in order to get an accurate quote. These may be estimated because they reflect the upcoming policy year.

At the annual policy audit, actual wages must be calculated and reported to reflect any changes.

This is not the same thing as wages paid out to injured workers. (As part of a workers' compensation claim, each state sets a percentage of weekly wages paid out to workers who are temporarily too injured or ill to work.)

Excluded from "gross wages" are tips or other gratuities, payments for group insurance or group pension plans, expense reimbursements and other fringe benefits.

A few things to keep in mind when pulling wages for workers' compensation insurance:

Some states have a payroll cap, which limits the amount reported for each employee. For example, in Nevada only the first $36,000 of each employee's wages are reported. If the employee makes less than $36,000 per year, their true salary is reported. Overlooking your state's payroll cap can result in paying more than necessary for workers' compensation insurance.

Payroll is multiplied by an assigned rate to calculate the insurance premium. This means total employee wages are directly tied to workers' compensation insurance costs.

Workers' compensation costs will increase or decrease based on:

And unlike the workers' compensation insurance rate set by the state rating bureau, payroll is in a small business owner's control.

Some insurance companies offer "pay-as-you-go" insurance, which is calculated based on payroll practically in real time.

Pay-as-you-go options are gaining in popularity because small business owners can make payments each time they run payroll. That means employers are only paying for the workers' compensation coverage they're actually liable for at any given time. If they add or lose employees, the premium will update — instead of waiting until the annual audit to receive a credit or debit.

If you opt for a pay-as-you-go payment plan, talk to your insurance agent for when and how to pull payroll numbers. Some payroll software providers integrate directly with insurers, to make payroll reporting easy, efficient and accurate.

How much does workers’ compensation insurance really cost?

The best way to get an accurate quote is to speak directly with an insurance agent — or get a quick online quote personalized for your business. However, the basic formula for calculating a workers’ compensation quote is:

Estimated Workers’ Compensation Cost =

(Gross Annual Employee Payroll / 100) x Workers’ Compensation Insurance Rate

To get an idea of how much your business might pay for workers' compensation coverage, follow these steps.

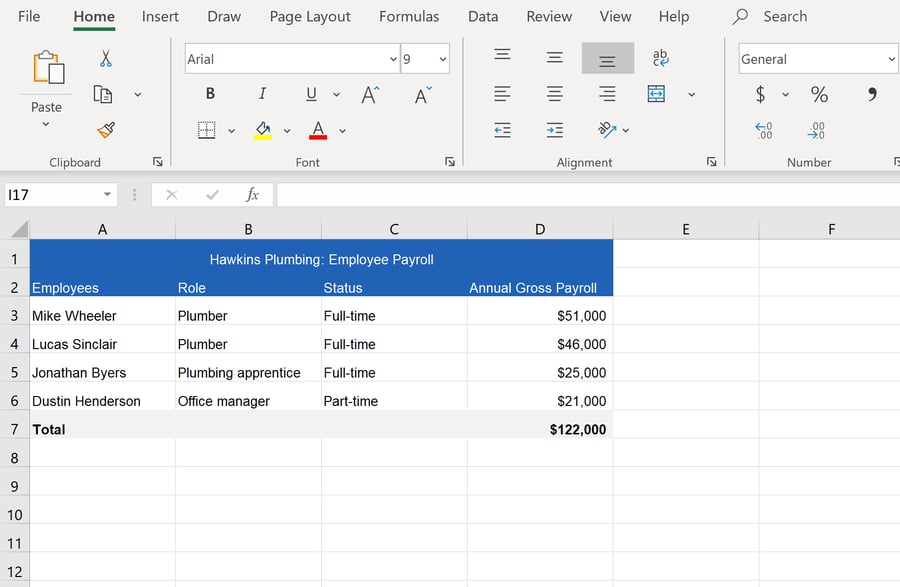

Only workers covered by the workers' compensation insurance policy need to be included in the payroll calculation. If state law legally requires your business to carry coverage, this likely means that all employees must be included. This means all W-2 employees whether they're full-time, part-time, seasonal or temporary and salaried or hourly.

Independent contractors and subcontractors usually don't need to be included, but check your state's laws and make sure you're not misclassifying any workers.

But other people often work for the business, too — particularly in very small businesses. Owners, officers, partners, LLC members, family members, etc. all fall into this category. The rules governing these workers differ on a state-by-state basis, and in some cases allow them to opt out or opt in to coverage.

Whether it's mandatory or voluntary, if these workers are going to be included in coverage, their wages must be included in the payroll calculation. If the owner is covered by the policy, submit total payroll including owner's compensation.

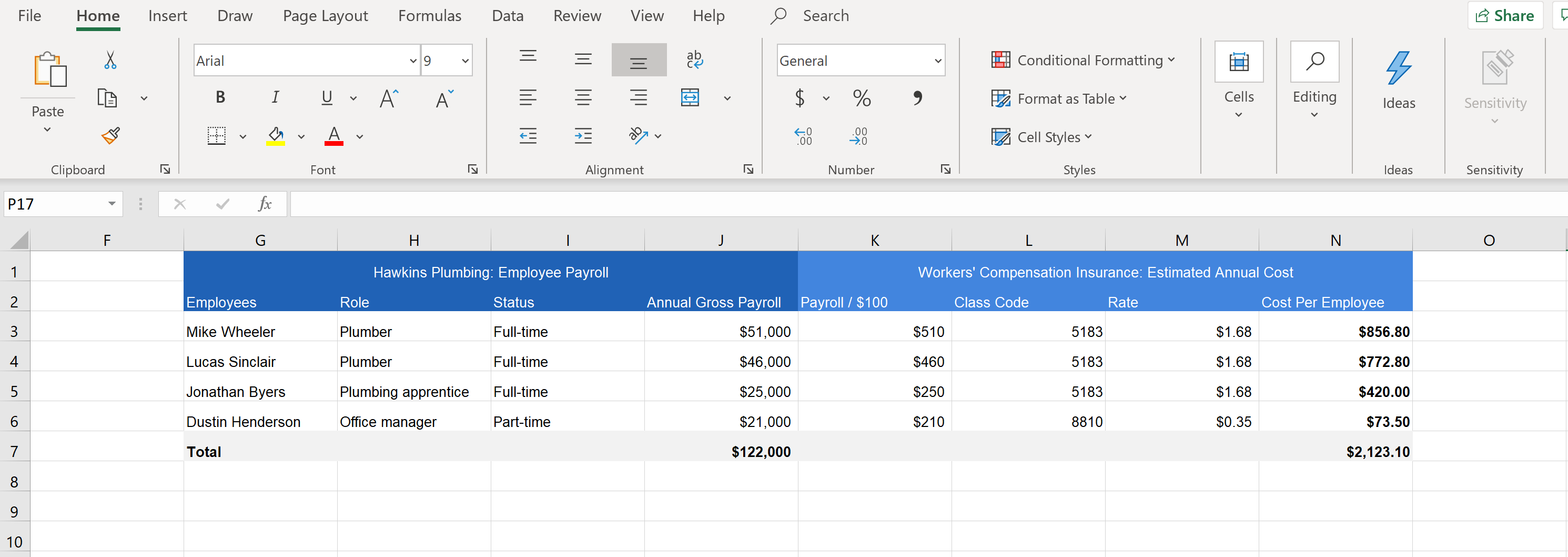

The rate for a clerical worker in Indiana is one-fifth the rate for a plumber, because of the higher risk for injury in plumbing compared to office work.

This is why you could overpay if you submit one lump amount for total payroll when shopping workers’ compensation insurance.

Instead, group employees based on the type of work they do. For small businesses, this usually includes:

Note that whether or not they travel matters for workers’ compensation as well. For example, an outside sales rep that meets with prospects in person, vs. an inside sales rep working a desk job.

For more on how to accurately categorize employees, read Workers Comp Insurance Cost: How to Avoid Overpaying.

There is a class code associated with every industry, which allows insurance carriers to better categorize companies and their employees. For example:

Workers’ compensation rates are assigned to each. You’ll need a class code for each type of worker, as the associated rate helps you calculate the estimated workers’ compensation cost.

Look up class codes and rates in one of three places:

WorkCompOne's online quoting tool makes it easy — just type in your industry to find out your classification code.

Check your payroll to pull pay details for each employee. Here’s how to handle common employment scenarios:

Keep in mind that these totals will be updated during the annual insurance audit, which is why they can be estimates of anticipated wages when a policy is purchased. The business will be credited or debited the difference based on actual pay at that time.

Once payroll has been pulled, find the total for each class code, and total payroll overall. These amounts can be rounded to the nearest $1,000.

When talking to an insurance agent or getting a quote online, have these numbers in front of you to get a quick and accurate price.

| Role (Class Code) | Payroll | Total Payroll By Class Code |

| Plumber (5183) | $80,000 + $50,000 | $130,000 |

| Clerical (8810) | $40,000 | $40,000 |

| TOTAL COMPANY PAYROLL | $170,000 | -- |

Workers’ compensation insurance rates can vary quite a bit from one U.S. state to another, and one industry to another.

For example, the rate for a plumbing business in Indiana might be $1.68 per $100 in payroll, while the rate for clerical work is just $0.35. But move those clerical workers to California, and their workers’ compensation rate might be $0.85 — nearly 1.5x higher.

This is why multiplying total payroll by the correct rate is so important to get an accurate estimate of your potential insurance costs. It’s also why you may need to divide employees into groups based on the type of work they do, so you don’t overpay on your policy.

Here's another scenario that's a little more realistic than the example above. Take for example an electrical business in Texas with two full-time electricians, both earning $70,000 per year, and one part-time clerical worker earning $20,200 per year.

The workers’ comp rate for electricians (NCCI code: 5190) is $1.44. Remember, rates are expressed per $100 in payroll.

So, in this case, you’d divide $140,000/$100, which equals $1,400. Then, multiply it by the class code rate of $1.44. This leaves you with a total estimated payroll of $2,016 or $1,008 per employee.

The clerical worker’s rate (NCCI code: 8810) is $0.16, and we’ll round their salary to $20,000. A $20,000 payroll with a workers’ compensation rate of $0.16 would cost just $32 per year.

| Role (Class Code) | Payroll |

| Electricians | $140,000 |

| Clerical | $20,000 |

| TOTAL PAYROLL | $160,000 |

| Role (Class Code) | Payroll | Payroll / $100 | Rate (per $100)* | Premium |

| Electricians | $140,000 | 1,400 | $1.44 | $2,016 |

| Clerical | $20,000 | 200 | $0.16 | $32 |

| TOTALS | $160,000 | 1,600 | -- | $2,048 |

*Example of annual workers' compensation insurance policy, base cost

This is a good estimate for what you will pay for a policy; however, your final quote will depend on additional credits or debits determined by the insurance carrier, the business’s history of claims and the liability limits you choose.

Learn more about what goes into your workers’ compensation quote.

Privacy Policy | Refund Policy | Terms of Use

© 2022 Custom Commercial Insurance Solutions, LLC. (“CCIS”) ALL RIGHTS RESERVED. (CA License #OH31762) The materials presented on this site are for general informational and educational purposes only. Any quotes or pricing information is non-binding, and the underwriting insurance company determines the policy premium following application. The policy controls the terms and conditions of any insurance issued.