Whether budgeting for the upcoming year or preparing information for tax season, you know there are certain small business expenses that remain relatively consistent: monthly electric bills, an annual software subscription, tools and supplies you need to operate, and so on. But when it comes to things like workers’ compensation insurance and small business policies, estimating expenses can be tricky.

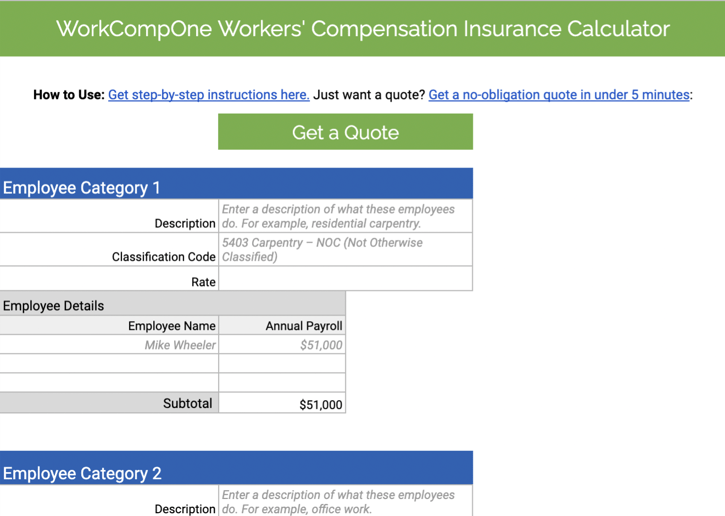

🎉New! We've created an interactive calculator to make it easier to estimate your workers' compensation premium (or gather the information you need to get a quote through WorkCompOne).

→ Download the Workers' Compensation Cost Calculator ←

How to Use The Calculator:

Download the workers' compensation calculation sheet, then follow along this post for step-by-step instructions to add up your insurance estimate.

Note: The following instructions will give you an estimate of workers’ compensation insurance cost. There are other factors that can and will affect the final premium. To get the most accurate price for your business, request a quote in just a few minutes.

To estimate your workers’ compensation premium, divide total payroll by 100, then multiply that number by your workers’ compensation insurance rate:

(Annual Employee Payroll / 100) x Workers’ Compensation Insurance Rate = Estimated Workers’ Compensation Cost

In other words, arriving at an estimate for workers’ compensation coverage involves a few different factors, which might change from year to year. Here's how to pull the correct data for your business.

First and foremost, you must comply with the laws of the state(s) in which your employees are performing work. Each state has its own laws surrounding workers’ comp, including who needs coverage and how it can be obtained.

Very small businesses may be exempt from workers’ comp laws, but most states require you carry a workers’ comp policy if you employ at least one person.

For example:

Keep in mind that full-time, part-time, temporary and seasonal employees are all counted as a full employee. This means that if a seasonal hire will meet your state’s employee limit, you need to have coverage in place on their first day.

Also, some states have industry-specific exceptions to the employee minimum; common ones include agriculture, domestic workers, trucking and construction.

Check your state's specific regulations here.

In some states, certain people that work with and for the business — such as family members and ownership roles — might be exempt from employee rule. This could include:

Some of these people can be considered non-employee workers and excluded from coverage without penalty; however, it’s important to note that they may count toward the total number of employees.

If you hire independent contractors, you could be held liable if they don’t provide workers’ compensation insurance for their subcontractors.

To learn more: Which Employees Legally Need to be Covered by a Workers' Comp Policy?

If your business is required to carry workers’ compensation insurance, you must purchase a policy that covers your full payroll, regardless of whether employees are full-time, part-time, temporary or seasonal. However, the insurance price differs based on the type of work the employees do, and relative risk for injury associated with that work.

Tip: Most small businesses can place their employees into the following groups:

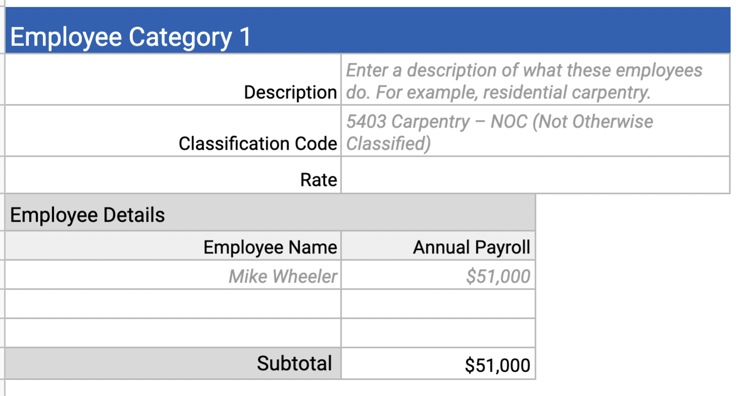

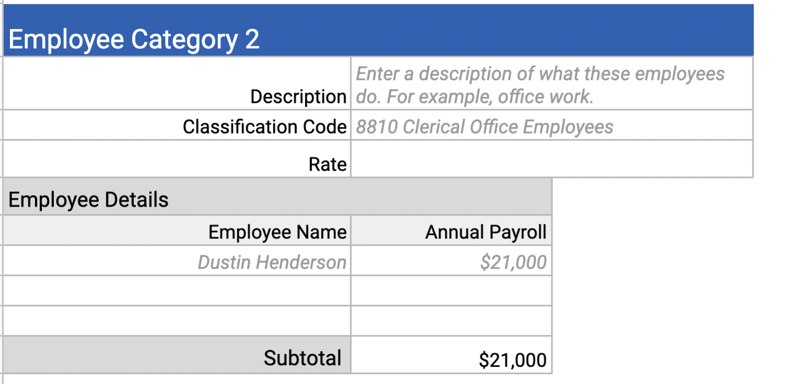

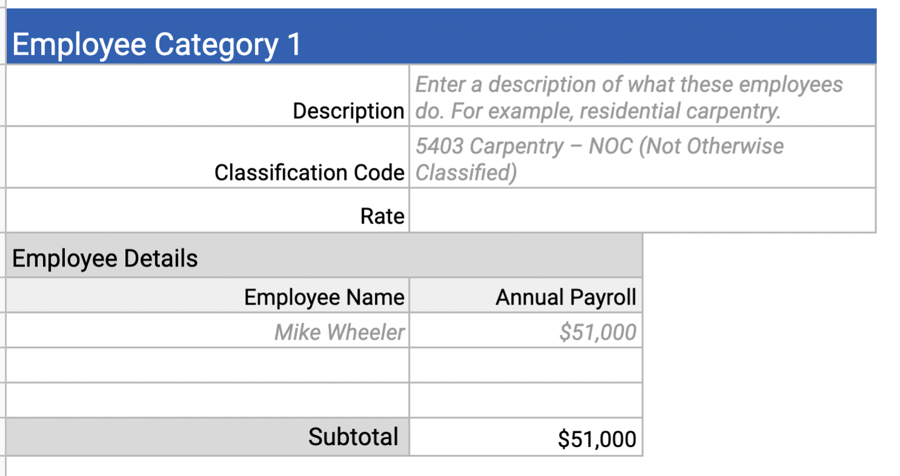

🔣 In The Calculator: Once you've divided employees into categories, label the employee category under "Description" and list each employee's name under "Employee Details."

A classification code (“class code”) is a numeric code that corresponds to a standardized list of industries, and is a way for insurance carriers to categorize companies. Class codes group together similar businesses, so data can be collected on workplace injuries and workers’ compensation claims.

These codes are defined by the National Council on Compensation Insurance (NCCI), an independent organization that collects workers’ compensation data on U.S. businesses. Based on the work your employees do, your business is assigned a class code that influences your final premium.

Each carrier has its own models for evaluating risk and calculating premium cost, but generally more dangerous class codes may be difficult or more expensive to cover (such as roofing or trucking).

Keep in mind that it’s possible for a business to have more than one class code. For example, a plumbing business might have an office administrator or secretary whose class code would differ from that of an actual plumber.

Knowing your employee class codes is crucial to ensuring you have the appropriate coverage, and it could also save you money. To find your class code, it’s best to work with an insurance agency that specializes in work comp. They can help you most accurately classify your business, modify your class code as needed, and avoid paying for the wrong classification.

🔣 In The Calculator: Once you know the classification code(s) that apply to your business, add the three- or four-digit number to the field labeled "Classification Code."

To learn more: How to Determine Employee Class Codes

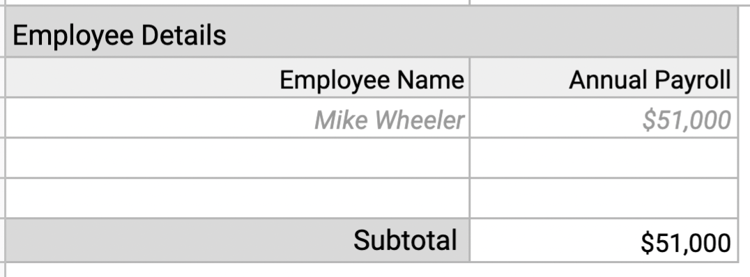

Once you’ve determined who needs to be covered and the class code and rate for each employee, add up the annual payroll for each. Payroll numbers can be rounded to the nearest thousand dollars.

If you’re unable to calculate the exact payroll for the year (for example, if a worker is paid hourly), estimate projected payroll. Actuals are reported when the business is audited at the end of the policy year. Depending on the differences between estimates and actuals, your account will be credited or debited accordingly.

🔣 In The Calculator: Enter the payroll beside each employee, and the calculator will automatically add up the payroll for each classification code and total payroll.

Tip: If you grossly underestimate payrolls, you’ll have a large audit premium payment due in addition to your normal invoices for the following year. Aim to be as accurate as possible, otherwise, you could wind up with a hefty end-of-year bill (and a hit to your cash flow). And no one wants that.

To learn more: How to Calculate Payroll to Find Your Workers’ Compensation Cost

The last piece of information you need to estimate your premium for a workers’ comp policy is your state’s workers’ compensation insurance rates.

Workers’ compensation cost is based on the rate set by your state’s rating agency or bureau. Check your state to find out what ruling body sets workers’ compensation rates.

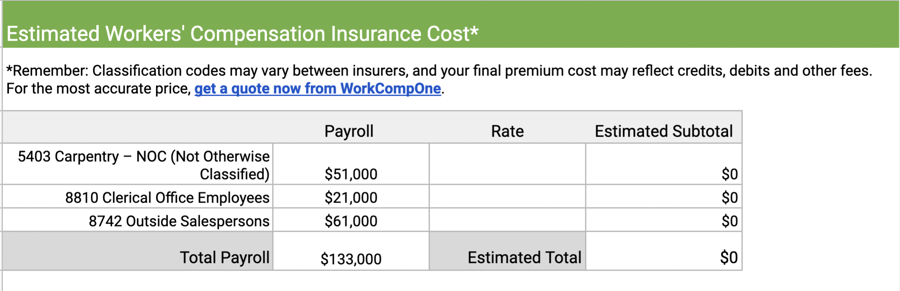

🔣 In The Calculator: If you're able to find the insurance rates for your business, enter them in the fields labeled "Rate."

This is where class codes come into play. Rating bureaus collect data from every business in your state, analyzing data from work comp claims and looking at class codes to determine a baseline cost of workers’ compensation coverage for all businesses operating within the state.

The workers’ compensation rate is represented as the cost per $100 in payroll. For example: A rate of $1.32 means that a business with $100,000 in payroll would pay $1,320 annually in work comp premiums, or $110 per month.

Some states require the insurer to use the workers’ compensation rates set by the state rating agency. These are called base rate states.

But in most states, insurance companies are allowed to deviate and instead use the state’s advised rates as a benchmark, meaning actual rates could vary from one insurer to the next. In these cases, each carrier will have its own models for evaluating risk and calculating the premium.

For the most accurate rate and best price, use an independent agency that can shop around and present you with the most competitive quote.

To learn more: Workers’ Compensation Insurance Rates: What They Are & How They’re Set

Now for a little math (we recommend using our calculator!).

Once you've entered the payroll and rates for each employee category, the WorkCompOne Workers' Compensation Insurance Cost Calculator will automatically calculate for you:

It's that easy! But if you want a full explanation of the math, we explain it in the following section.

Now let's break down the math. Consider an Indiana plumbing business that has two plumbers employed; a master plumber who makes $80,000 per year, and an apprentice that makes $50,00 per year. It also has one office manager, who handles clerical tasks and is paid $40,000 per year.

As we mentioned earlier, this payroll is their estimated gross annual earnings, rounded to the nearest thousand.

By grouping employees by class code, we know that we need to find the sum of our plumbing payroll:

$80,000 + $50,000 = $130,000 in plumbing payroll

We look up rates in Indiana, and they are $1.68 and $0.35, respectively.

| Role | Class Code | Rate (per $100) |

| Plumber | 5183 | $1.68 |

| Clerical | 8810 | $0.35 |

Rates are expressed per $100 in payroll, so we divide our $130,000 plumber payroll and $40,000 clerical payroll by $100:

$130,000 / 100 = 1,300 in plumbing payroll

$40,000 / 100 = 400 in clerical payroll

Then, multiply by the rate for that class code:

1,300 x $1.68 = $2,184

400 * $0.35= $140

Lastly, add up the cost per class code:

$2,184 + $140 = $2,324

Based on these 2018 rates in Indiana, this plumbing business with $170,000 in payroll could expect to pay approximately $2,324 in annual workers’ compensation cost - or, less than $200 per month.

| Role (Class Code) | Payroll | Payroll / $100 | Rate (per $100)* | Premium |

| Plumber (5183) | $80,000 + $50,000 | 1,300 | $1.68 | $2,184 |

| Clerical (8810) | $40,000 | 400 | $0.35 | $140 |

| TOTAL | -- | -- | -- | $2,324 |

*Example of annual workers' compensation insurance policy cost based on 2018 Indiana rates.

If operating in a base rate state, this total amount is your workers’ compensation premium, before credits and debits are applied (more on that below). Base rate states require all insurers to use the workers’ compensation rates set by the state rating agency.

For those not in base rate states, the premium could vary based on the insurer you choose. Insurance carriers must submit their rates to the state’s regulatory body for approval, but rates may vary based on their individual history of losses.

To learn more: How to Calculate Workers’ Compensation Cost Per Employee

You might be wondering, Why isn't this easier? In short, because there are a lot of different factors at play.

Your payroll and rate will give you a good estimate of workers’ compensation costs, but your final premium may look a little different.

Even though the formula to calculate a workers' compensation insurance premium is relatively straightforward — the inputs can vary, and aren't always decided by the insurance company.

Rates are set for each class code and within each state. Sometimes insurance company's can offer a different rate set by the state rating agency — and sometimes they can't. This is why looking up a workers' compensation rate for a particular state or industry isn't always particularly helpful: They may not fully represent a real-world insurance quote.

On top of this, the insurance carrier may take other factors into consideration when calculating a quote to best reflect your business.

A workers’ compensation rate assigns a price tag to businesses within the same industry, but workplace safety and workers’ compensation claims can vary widely from one company to the next. Your final premium may increase or decrease based on:

The insurer may apply credits or debits to the premium to determine the final quote you’re offered. To save money on your workers’ compensation policy, ask an insurance agent for advice and programs or training that may qualify your business for savings.

Our recommendation? Use the calculator to add up employee payroll, then get a free quote from WorkCompOne in just minutes.

Editor's note: This post was updated in 2023 to be more current and comprehensive. It was originally published in 2019.

Privacy Policy | Refund Policy | Terms of Use

© 2022 Custom Commercial Insurance Solutions, LLC. (“CCIS”) ALL RIGHTS RESERVED. (CA License #OH31762) The materials presented on this site are for general informational and educational purposes only. Any quotes or pricing information is non-binding, and the underwriting insurance company determines the policy premium following application. The policy controls the terms and conditions of any insurance issued.